The risk no one warns you about 🚩

What Touker Suleyman wants you to know about personal guarantees

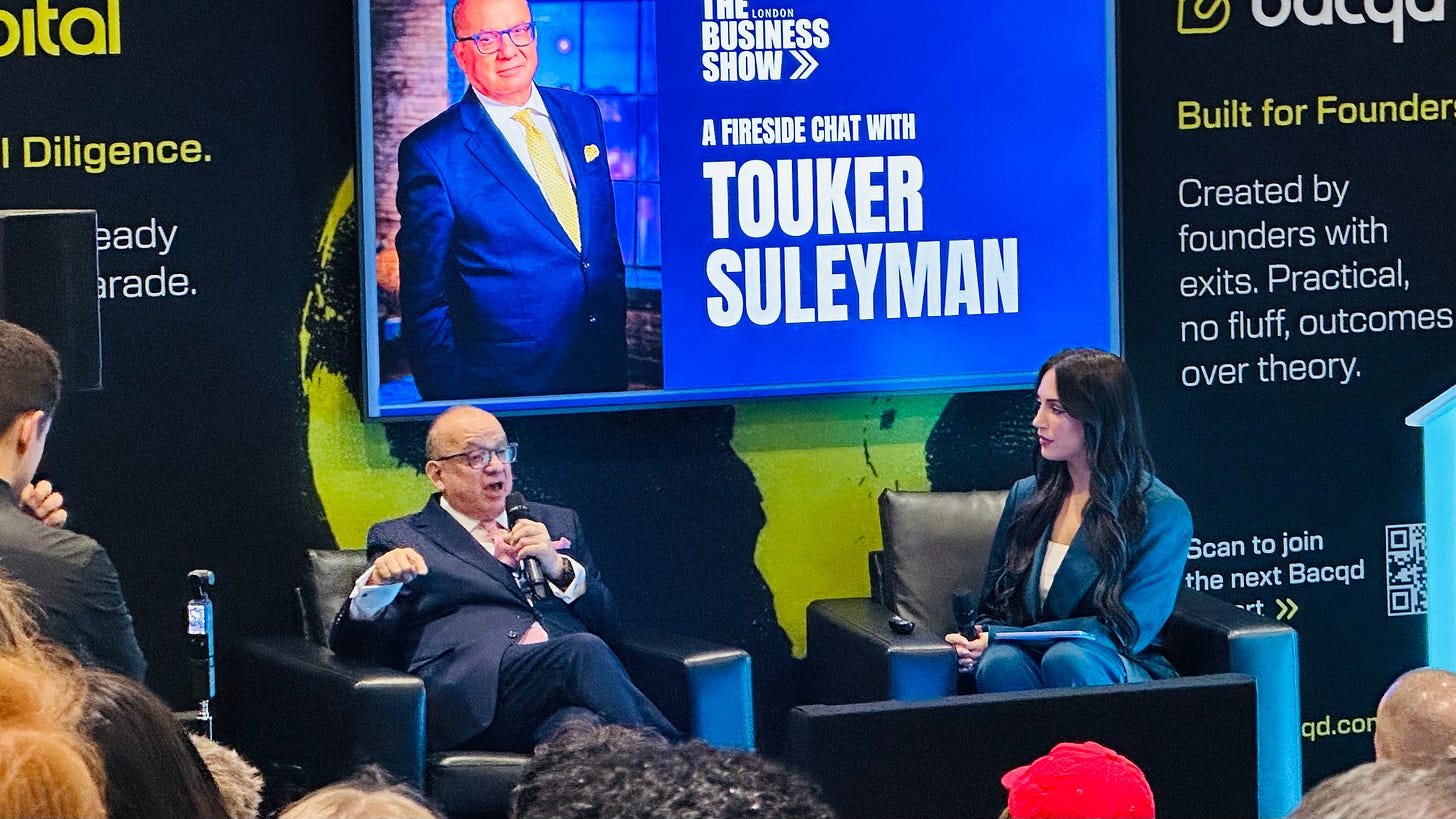

I spent this week at The Business Show in London. I walked into a talk by retail entrepreneur and Dragon’s Den investor Touker Suleyman expecting the usual survival-mode advice… stay resilient, push through, keep grinding… the standard stuff.

Instead, he said something that caught me off guard. He looked across the room and said:

“Never take on a new business if it’s going to put in jeopardy your main business. Never, never give a personal guarantee on anything.”

I wish someone had said that to me years ago.

When previous ventures of mine went sideways, the real pain wasn’t the failure. It was the aftermath. The obligations I had signed without thinking. The ones that followed me long after the company was gone.

Most founders I meet never talk about this part. It isn’t exciting and it doesn’t fit the upbeat founder narrative, but it influences your life more than any motivational talk ever could.

Touker’s message deserved more attention, so here’s what he meant and why it matters. 👇🏻

— Millennial Masters is sponsored by Jolt ⚡️ Reliable hosting for modern builders

The risk that follows you home

During the session, Touker spoke about banks with unusual honesty. He said:

“Banks today are like pawnbrokers. They want to lend you money. They want your personal guarantee.”

Later he added: “Never, never give a personal guarantee on anything.”

He wasn’t exaggerating. If the business fails, the guarantee doesn’t disappear with it. It stays attached to you. Not your company… you.

Founders often fixate on interest rates or repayment terms and miss the clause that changes everything.

Personal guarantees feel harmless when things are going well. They turn into a trap the moment the market shifts or the business hits turbulence.

Here’s the part most people overlook: personal guarantees aren’t just for loans. They hide inside everyday business agreements.

I’ve seen them in:

office leases

serviced workspace contracts

equipment rental

accountancy and legal engagement letters

merchant cash advance deals

supplier credit agreements

fit-out and refurbishment contracts

You assume it’s standard paperwork, you sign, and get on with your day. And without realising it, you’ve accepted personal responsibility for something you thought belonged to the company.

Touker’s warning was simple: know exactly what carries your name and push back wherever you can. Many founders don’t realise how much room they have to negotiate until they ask.

The mistake that burns your cash

Later in the talk, Touker turned to a problem he sees repeatedly.

Founders raise money and immediately pour large sums into Meta and Google ads without knowing the true return.

He said that too many businesses treat paid traffic as a shortcut, then discover later that most of the spend went nowhere.

He encouraged the room to look for routes that travel further without draining budgets. Think influencers, collaborations, and creative ideas that spread because they’re interesting, not because you paid for reach.

It wasn’t anti-marketing, but a reminder to protect your cash when conditions are tough and attention is expensive.

What time in the game teaches you

Touker Suleyman has lived through decades of good markets and bad ones.

The message he delivered this week wasn’t loud or glamorous, but it was the one founders needed to hear.

The hardest setbacks usually pass.

The ones that linger are the avoidable commitments and the unnecessary spending that creeps up when you’re moving fast.

So before you sign something new or double your ad budget, take a moment to ask yourself:

Do I understand every liability with my name on it?

And am I investing in growth or just fuelling a habit?

If those answers aren’t clear, pause. Your future self will thank you.

This is a really important message for anyone in business!

I love jeopardy.. 😬